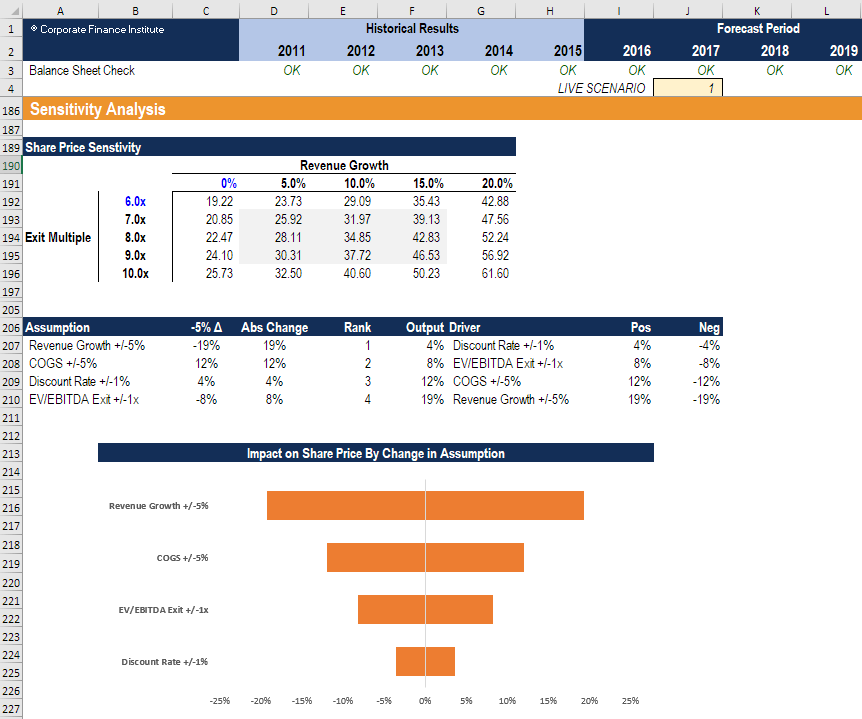

Rate each variables relationship to each output variable on a 1-to-10 scale 5. Overview of what is financial modeling how why to build a model. This is a guide to Sensitivity Analysis. Each cell may contain either numeric or text data or the results of formulas that automatically calculate and display a value based on the contents. In our template this would be either cell D14 D15 or D16. Sensitivity Analysis is fundamental when we have to do Discount Cash Flows and want to check the sensitivity of Fair Price when we change variables like Growth Rates of Company and Weighted Average Cost of Capital. 3 Implement data analysis in Excel to identify the best opportunities for Watershed to increase revenue and maximize profits while managing any. This was the result of the sensitivity analysis in excel. This advanced financial modeling course will teach you how to perform Excel sensitivity analysis with a focus on practical applications for professionals working in investment banking equity research financial planning analysis. Spreadsheets were developed as computerized analogs of paper accounting worksheets.

Key Requirements to Set Up the Tables. Compares aggregate values of three or more variables represented on axes starting from the same point. Sensitivity analysis in excel helps us study the uncertainty in the output of the model with the changes in the input variables. Choose Two Input Assumptions Variables and Decide on the Ranges You Would Like to Test. B Select the range of cells that contains the formulas and values that you want to substitute. Van Westendorp results are displayed graphically for analysis using plots of cumulative percentages. CFIs financial model template library has hundreds of free Excel file downloads to help you become a world-class financial analyst. This was the result of the sensitivity analysis in excel. Youll need to set up the bucketsso it might be worth rank ordering the responses to get a good idea of the right buckets. Determine how each selected input variable can go wrong and place that in the Cause column of the FMEA.

We also provide a downloadable excel template. A Pole Plot is the most basic representation of the orientation data. CFIs financial model template library has hundreds of free Excel file downloads to help you become a world-class financial analyst. Sensitivity Analysis In Excel. Determine how each selected input variable can go wrong and place that in the Cause column of the FMEA. Here we discuss how to calculate sensitivity analysis along with practical examples. Criteria decision making Selecting the best alternative from the pool of the available different alternatives. You cannot use assumptions or drivers from other sheets such as the 3-statement model in. To recap and summarize this article here are the key requirements for Excel-based sensitivity analysis. Now we can move on to the step-by-step guide to sensitivity analysis in excel.

Sensitivity Analysis is fundamental when we have to do Discount Cash Flows and want to check the sensitivity of Fair Price when we change variables like Growth Rates of Company and Weighted Average Cost of Capital. Determine how each selected input variable can go wrong and place that in the Cause column of the FMEA. Sensitivity Analysis is a tool used in financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a companys financial performance. CFIs financial model template library has hundreds of free Excel file downloads to help you become a world-class financial analyst. Key Requirements to Set Up the Tables. According to requirement management plan this template work accordingly. 1 Elicit information about important variables relevant to your analysis. Explore and download the free Excel templates below to perform different kinds of financial calculations build financial models and documents and create professional charts and graphs. Rate each variables relationship to each output variable on a 1-to-10 scale 5. To analyze how the different values of a set of independent variables affect a specific dependent variable under certain.

Select the top input variables to start the FMEA process. Explore and download the free Excel templates below to perform different kinds of financial calculations build financial models and documents and create professional charts and graphs. Overview of what is financial modeling how why to build a model. Van Westendorp results are displayed graphically for analysis using plots of cumulative percentages. You cannot use assumptions or drivers from other sheets such as the 3-statement model in. Now you need to analyze the valid data. List of Financial Model Templates. 1 The input variables and output must be on the same spreadsheet as the table. Here we discuss how to calculate sensitivity analysis along with practical examples. Choose Two Input Assumptions Variables and Decide on the Ranges You Would Like to Test.